Never has the stock market run so far ahead of the economy…

Whack…

Gold’s smashing records right now. But DON’T buy physical gold right now. Click here to discover a much more powerful strategy to collect an extra $12,000 to $15,000… or even $52,000 a year from gold… without buying actual gold.

Dear Reader,

The S&P 500 has leapt 36% within the past six months.

The so-called Buffett Indicator — the ratio of total stock market capitalization relative to gross domestic product — rises to a record 221%.

In words other, the stock market wings along at over twice the value of the economy it supposedly reflects.

Since 1970, a ratio of 85% is about par. That is, the stock market… across 55 years… has generally lagged the economy.

Yet at present the economy lags the stock market by a factor exceeding two.

During the stock market deliriums of the 2000 “dot-com” bubble, the Buffett Indicator apexed only at 142%.

Extremely “Out of Whack”

Thus the balance between stock market and economy is extremely “out of whack.”

And I am fond to cite newsletter man Bill Bonner, who wrote:

“Things that are extremely out-of-whack eventually work their way back into whack.”

The Buffett Indicator has remained above its long-term 85% average for 13 consecutive years.

Assume the theory of whack reversion contains juice.

We must therefore assume that the ratio will fall beneath its long-term 85% average for some future 13-year span.

Now, perfect whack is rarely ever attained in this imperfect world of odd angles, imprecise cuts and irregular surfaces.

Yet even partial whack represents substantial reordering and rearranging from today’s imbalance.

Gold’s Way Out of Whack

Even gold ranges out of whack.

For the first time in history, gold barreled past $4,000 this week.

Gold has bounded some 53% higher this year alone… showing even the stock market its dust.

The metal has yielded some four times the return of the mighty S&P 500 this year.

Why? Explains MarketMinute:

Several interconnected factors have fueled this sustained gold rally. Persistent global inflation, with the U.S. rate stubbornly above the Federal Reserve's 2% target, has made gold an attractive hedge.

Geopolitical tensions, including the ongoing U.S. government shutdown, a political crisis in France, and the lingering effects of Russia's 2022 invasion of Ukraine, have significantly amplified gold's safe-haven appeal.

Central banks globally have been aggressively accumulating gold reserves, marking the fastest pace in modern history, driven by concerns over "dollar weaponization" and a strategic diversification away from traditional reserve currencies…

A weaker U.S. dollar, down nearly 10% this year, has also made gold more affordable for international buyers, while increasing private investor demand, particularly through Exchange Traded Funds (ETFs), has provided the latest thrust to the rally.

I hazard there is much justice here. Yet is the excitement “sustainable,” as the term goes?

SPONSORED: BANYAN HILL

[OCTOBER 16] Reagan's Most Quoted Author Issues Final Warning

President Reagan quoted George Gilder more than any other living author.

He gave Gilder's books to cabinet members.

Awarded him the White House Award for Entrepreneurial Excellence.

The reason? Gilder could see the future before anyone else.

Now Gilder says an October 16th announcement will confirm his latest prediction - one he believes will create more millionaires than we've seen in decades.

The Way Ahead

I would remind you that gold is presently a financial asset — it is no longer a monetary asset.

Thus it is subject to the customary manias, zealotries and delusions that afflict financial assets.

It is therefore susceptible to bubble formation.

Yet for what it is worth — I repeat, for what it is worth — the crackerjacks at Goldman Sachs divine that gold will post $4,900 by 2026’s close.

If true, gold will remain up and going through next year at least.

Now let us take the long view.

Freedom Financial News contributor Jim Rickards has forecasted that gold could ultimately scale $10,000 the ounce. Perhaps even $15,000 the ounce.

Yet did he undershoot the target? Could gold potentially summit the Himalayan height of $40,000 the ounce?

$40,00 Gold — “A Reasonable Projection”

“Austrian” school economist S. Nagasundarum:

Most analysts remain oblivious of the underlying causes and attribute the move in gold prices to economic uncertainty, geopolitics, Fed rate cuts, higher price inflation, Trump’s tariffs, and other secondary factors.

However, the Numero Uno factor is the return of Gold to the centre of the world’s monetary system, and these are very early days as part of that transition. I would not be entirely surprised by an addition of “0” to the current gold price over the next 5 years…

$40,000/oz does indeed seem to be a reasonable projection.

Just so. But how does this fellow alight upon the gobsmacking $40,000 figure?

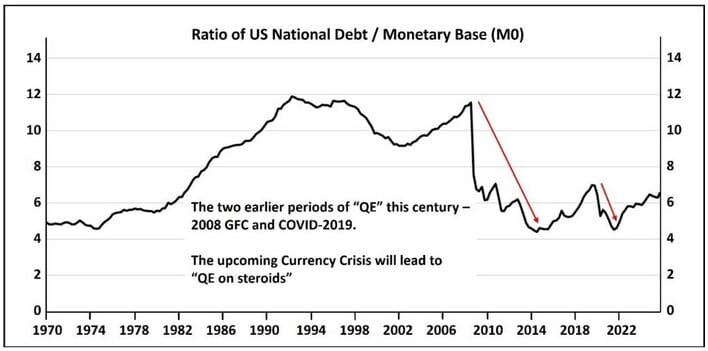

The answer centers upon the ratio of United States national debt to the monetary base (M0).

The Breakdown

Here are the details:

Nearly $30 trillion of US debt will need to be sold over the next three years. What will that do to the Monetary Base?...

When the Fed monetizes the deficit, it does so by buying Treasury securities (typically long-dated) by creating new currency, which increases the Monetary base. When there is a massive expansion of the deficits, a significantly large portion of the US National Debt must be financed by the US Federal Reserve, which increases the monetary base.

This causes the [national debt-to-monetary base] ratio to decline, as we witnessed during the 2008 GFC as well as during the COVID-19 pandemic. From these lows, the ratio has increased to 6+ as indeed it has today.

Please consult this chart for details:

Source: Dollarcollapse.com

The Looming “QE Tsunami”

The case hinges upon a looming “QE tsunami”:

So, merely retesting the two immediate prior lows (at around 4) of the National debt-to-M0 ratio could send Gold’s target to $40,000 in the QE tsunami that is just ahead.

A strong case can be made for why this 4 is a high number, given the bankrupt nature of US finances today, and that we should expect to see much lower levels in the years ahead.

Even if the ratio doesn’t drop much below 4, the National debt itself is expected to witness a steep increase in the years ahead, leading to a significantly higher monetary base.

I do not know if this projected reality will materialize. Thus I do not know if gold will scale $40,000 the ounce, $20,000 the ounce or even $5,000 the ounce.

Yet I return to the concept of whack.

Gold Represents a Return to Whack

For thousands of years, gold represented authentic money.

That is, gold represented whack.

Yet in recent decades governments have seized from gold its historic monetary role.

Thus they have shoved the monetary system out of historical whack.

And so it may just be that the gold price… which currently appears so out of whack… actually represents an overdue reversion to whack.

In which case the United States dollar will get whacked — good — and hard.

Regards,

Brian Maher

for Freedom Financial News

P.S. Gold has smashed through $4,000 for the first time in history.

It’s the best-performing asset class of 2025, up an astounding 38.7%.

BUT… If you’re looking for maximum income, DO NOT buy physical gold right now.

Instead, do THIS.

In previous bull runs, this secret has been shown to be 11 times more profitable than buying the metal — and it’s actually even easier to do.